Low Interest Personal Loans: Save Money And Increase Affordability

Delving into low interest personal loans, this introduction immerses readers in a unique and compelling narrative, highlighting the benefits of saving money and increasing affordability through smart financial decisions. Exploring the world of personal finance, especially in terms of loans, opens up a realm of possibilities for individuals looking to secure their financial future.

Understanding the intricacies of interest rates, eligibility criteria, and repayment options can empower borrowers to make informed decisions and achieve their financial goals. This discussion aims to shed light on the nuances of low interest personal loans, guiding readers towards a path of financial stability and success.

How can you prepare a healthy breakfast?

Eating a healthy breakfast is essential for starting your day off right. It provides you with the necessary nutrients and energy to kickstart your metabolism and keep you feeling full and satisfied until your next meal.

Option 1: Greek Yogurt Parfait

A Greek yogurt parfait is a delicious and nutritious breakfast option. It is packed with protein, calcium, and probiotics, making it a great choice for a healthy morning meal.

- Ingredients: Greek yogurt, fresh fruits (such as berries or bananas), granola, honey.

- Nutritional Information: High in protein, fiber, and vitamins. Low in added sugars if you choose plain yogurt and limit the honey.

- Preparation: In a glass or bowl, layer Greek yogurt, fruits, granola, and drizzle with honey. Repeat the layers and enjoy!

Option 2: Avocado Toast

Avocado toast is a trendy and nutritious breakfast choice. Avocados are rich in healthy fats, fiber, and various vitamins and minerals.

- Ingredients: Whole grain bread, ripe avocado, cherry tomatoes, feta cheese, olive oil.

- Nutritional Information: Good source of healthy fats, fiber, and antioxidants. Helps keep you full and satisfied.

- Preparation: Toast the bread, mash the avocado, spread it on the toast, top with sliced tomatoes, crumbled feta, and a drizzle of olive oil.

Option 3: Veggie Omelette

A veggie omelette is a protein-packed breakfast that can be customized with your favorite vegetables for added nutrients.

- Ingredients: Eggs, bell peppers, spinach, tomatoes, onions, cheese.

- Nutritional Information: High in protein, vitamins, and minerals. Low in carbs if made without added ingredients like potatoes.

- Preparation: Beat eggs, pour into a heated skillet, add chopped veggies and cheese, fold over, and cook until set. Serve hot with a side of whole grain toast.

Factors affecting interest rates on personal loans

Interest rates on personal loans are influenced by various factors that determine the cost of borrowing money. Understanding these factors can help individuals make informed decisions when applying for a loan.

Credit Scores Impact

Credit scores play a significant role in determining the interest rates on personal loans. Lenders use credit scores to assess the creditworthiness of borrowers and determine the risk associated with lending money. Individuals with higher credit scores are likely to qualify for lower interest rates, as they are considered less risky borrowers. On the other hand, individuals with lower credit scores may face higher interest rates due to the perceived higher risk of default.

Loan Terms and Amounts

The terms of a personal loan, such as the repayment period and loan amount, can also affect the interest rates. Generally, loans with shorter repayment periods tend to have lower interest rates compared to loans with longer terms. Additionally, the loan amount can impact the interest rate, with larger loan amounts often resulting in higher interest rates. Lenders may also offer lower interest rates for secured loans, where the borrower provides collateral to secure the loan.

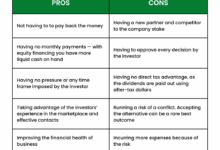

Pros and cons of opting for low interest personal loans

When considering low interest personal loans, it is essential to weigh the advantages and disadvantages to make an informed decision.

- Advantages of Low Interest Personal Loans: Opting for a low interest personal loan can lead to significant cost savings on interest payments over time. By securing a loan with a lower interest rate, borrowers can reduce the total amount paid back, making it a more affordable financing option.

- Drawbacks of Low Interest Personal Loans: While low interest rates can be appealing, they may come with stricter eligibility criteria or longer approval processes. Borrowers with less-than-perfect credit scores or limited income may find it challenging to qualify for these favorable rates.

Real-life Scenarios:

- Beneficial Scenario: Consolidating high-interest debt with a low interest personal loan can help borrowers save money in the long run by paying off expensive debts more efficiently.

- Detrimental Scenario: In some cases, the low interest rate on a personal loan may be offset by high fees or additional costs, diminishing the overall savings potential.

Short-term vs. Long-term Impact:

- Short-term Financial Goals: Low interest personal loans can provide immediate relief by lowering monthly payments and reducing the financial burden, making it easier to manage cash flow in the short term.

- Long-term Financial Stability: While low interest rates can be advantageous in the short term, borrowers should consider the long-term implications, including the total cost of borrowing and the impact on overall financial health and stability.

Types of lenders offering low interest personal loans

When looking for low interest personal loans, borrowers have various options when it comes to choosing a lender. Different types of financial institutions offer these loans, each with its own set of pros and cons. It’s important to understand the differences between banks, credit unions, and online lenders before deciding where to borrow from.

Banks

- Banks are traditional financial institutions that offer a wide range of financial products, including personal loans.

- Pros: Banks often have a strong reputation, established customer service, and in-person assistance for loan applications.

- Cons: Banks may have stricter eligibility requirements, longer approval processes, and may not always offer the lowest interest rates.

Credit Unions

- Credit unions are member-owned financial cooperatives that offer services to members.

- Pros: Credit unions typically offer competitive interest rates, personalized service, and may have more flexible terms for loans.

- Cons: Membership requirements may be necessary, and access to branches or ATMs may be limited compared to banks.

Online Lenders

- Online lenders operate solely through digital platforms, offering convenience and quick loan approval processes.

- Pros: Online lenders often have lower overhead costs, which can translate to lower interest rates for borrowers.

- Cons: Some online lenders may have less stringent eligibility requirements, leading to higher interest rates for some borrowers.

Eligibility criteria for low interest personal loans

When applying for low interest personal loans, it is important to meet certain eligibility criteria to qualify for the best rates and terms. Factors such as income, credit history, and employment status play a significant role in determining your eligibility for these loans.

Factors influencing eligibility for low interest personal loans

- Income: Lenders often look for a stable source of income to ensure you can repay the loan.

- Credit history: A good credit score demonstrates your ability to manage debt responsibly and may result in lower interest rates.

- Employment status: Having a steady job can increase your chances of qualifying for a low interest personal loan.

Tips to improve eligibility

- Pay bills on time to maintain a good credit score.

- Reduce existing debt to improve your debt-to-income ratio.

- Provide accurate and up-to-date documentation when applying for the loan.

Importance of maintaining a good credit score

A good credit score can help you secure lower interest rates and better loan terms.

Lenders use your credit score to assess your creditworthiness and the risk of lending to you.

Documentation required for low interest personal loans

- Proof of income (pay stubs, tax returns)

- Identification documents (driver’s license, passport)

- Bank statements

- Proof of employment

Comparison of eligibility criteria among different lenders

- Traditional banks may have stricter requirements compared to online lenders.

- Online lenders may focus more on alternative data for eligibility assessment.

Guide to check and monitor your credit score

- Regularly review your credit report for any errors or discrepancies.

- Use credit monitoring services to stay updated on changes to your credit score.

Negotiating with lenders for better terms

- Highlight your strong financial position and credit history to negotiate for lower interest rates.

- Consider pre-qualification to compare offers from different lenders.

Checklist before applying for a low interest personal loan

- Review your credit report for accuracy.

- Gather all necessary documentation for the loan application.

- Compare interest rates and terms from multiple lenders.

Application process for low interest personal loans

When applying for a low interest personal loan, there are several steps involved to ensure a smooth process from start to finish. It is essential to understand the documentation required, the approval process, eligibility criteria, and the importance of your credit score.

Steps involved in applying for a low interest personal loan

- Research and compare lenders offering low interest rates.

- Fill out the loan application form with accurate information.

- Submit the required documentation for verification.

- Wait for the lender to review your application.

- Receive approval or denial of your loan application.

Documentation required during the application process

- Proof of identity (such as a driver’s license or passport).

- Proof of income (such as pay stubs or tax returns).

- Bank statements to show financial stability.

- Other personal information as requested by the lender.

Approval process and timeline for receiving funds

The approval process typically takes a few days to a week. Once approved, funds are usually disbursed within a few business days.

Eligibility criteria for low interest personal loans

- Good credit score.

- Stable income and employment history.

- Low debt-to-income ratio.

- Meeting the lender’s specific requirements.

Types of low interest personal loans available

- Fixed-rate personal loans.

- Variable-rate personal loans.

- Debt consolidation loans.

- Secured personal loans.

Importance of credit score in the application process

- Your credit score plays a significant role in determining the interest rate you qualify for.

- A higher credit score can help you secure a lower interest rate on your personal loan.

Tips to improve your chances of approval

- Work on improving your credit score before applying.

- Pay off existing debts to lower your debt-to-income ratio.

- Provide accurate and up-to-date information on your application.

- Consider adding a co-signer with a good credit history.

Repayment options and terms for low interest personal loans

When it comes to repaying low interest personal loans, borrowers have various options to choose from based on their financial situation and preferences. Understanding the different repayment options and terms can help individuals manage their loan effectively and minimize the overall cost.

Repayment Options for Low Interest Personal Loans

- Fixed Monthly Payments: With this option, borrowers make the same payment amount each month until the loan is fully repaid. This offers predictability and stability in budgeting.

- Graduated Repayment Plans: These plans start with lower monthly payments that gradually increase over time. This can be beneficial for borrowers expecting an increase in income.

- Income-Driven Repayment Plans: These plans adjust monthly payments based on the borrower’s income, making it more manageable for individuals with fluctuating income levels.

Impact of Loan Terms on Repayment

Loan terms such as the duration of the loan and repayment frequency can significantly impact the total interest paid. For instance, a longer loan duration may result in lower monthly payments but higher overall interest costs. Repayment frequency, whether monthly or bi-weekly, can also affect the total interest paid over the life of the loan.

Strategies for Managing Loan Repayments

- Setting Up Automatic Payments: Automating loan payments can help avoid missed or late payments, ensuring timely repayment.

- Creating a Budget: Prioritizing loan payments in a budget can help borrowers allocate funds efficiently and avoid defaulting on the loan.

- Considering Debt Consolidation: Consolidating multiple loans into a single low interest personal loan can simplify repayment and potentially lower the overall interest rate.

Pros and Cons of Different Repayment Options

- Pros of Fixed Monthly Payments: Predictable payments for better budgeting.

- Cons of Graduated Repayment Plans: Higher overall interest costs due to lower initial payments.

- Pros of Income-Driven Repayment Plans: Adjustments based on income levels for better manageability.

Impact of low interest personal loans on credit scores

Taking out a low interest personal loan can have a significant impact on your credit score, both positively and negatively. It’s important to understand how these loans can affect your credit standing and to manage them responsibly to maintain or improve your credit score.

Benefits of using low interest personal loans to build credit

- Timely repayment of low interest personal loans can demonstrate to credit bureaus that you are a responsible borrower, which can boost your credit score.

- Diversifying your credit mix by adding an installment loan, such as a personal loan, to your credit profile can also have a positive impact on your credit score.

- Consolidating higher-interest debt with a low interest personal loan can improve your credit utilization ratio, which is another factor that affects your credit score.

Drawbacks of using low interest personal loans

- If you are unable to make timely payments on your low interest personal loan, it can have a negative impact on your credit score and lead to late payment penalties.

- Applying for multiple low interest personal loans within a short period can result in multiple hard inquiries on your credit report, which can temporarily lower your credit score.

Tips for responsibly managing low interest personal loans

- Make sure to make timely payments on your low interest personal loan to avoid any negative impact on your credit score.

- Avoid taking out more loans than you can afford to repay, as defaulting on a loan can severely damage your credit score.

- Regularly monitor your credit report to check for any errors or inaccuracies that could be affecting your credit score.

Alternatives to low interest personal loans

When considering financing options, individuals have alternatives to low interest personal loans that may better suit their needs. These alternatives include credit cards, peer-to-peer lending, and secured loans. Each option has its pros and cons, and personal financial goals and circumstances play a significant role in determining the most suitable choice.

Credit Cards

Credit cards offer a convenient way to access funds quickly, but they often come with high-interest rates compared to personal loans. The flexibility of credit card usage can be advantageous for smaller purchases or emergencies. However, carrying a balance on a credit card can lead to long-term debt accumulation due to compounding interest.

Peer-to-Peer Lending

Peer-to-peer lending platforms connect borrowers directly with individual investors, cutting out traditional financial institutions. This can result in lower interest rates for borrowers with good credit. However, the approval process may be stricter, and the loan amounts could be limited compared to traditional lenders.

Secured Loans

Secured loans require collateral, such as a home or car, to secure the loan amount. This can lead to lower interest rates compared to unsecured personal loans. However, failing to repay a secured loan could result in the loss of the collateral. Secured loans are often used for larger purchases like home renovations or vehicle purchases.

Common misconceptions about low interest personal loans

There are several misconceptions surrounding low interest personal loans that often lead to confusion among borrowers. Let’s debunk some of these myths and clarify the facts.

Low interest personal loans are only for people with perfect credit scores

Contrary to popular belief, low interest personal loans are not exclusively reserved for individuals with flawless credit histories. While a good credit score can help you qualify for the best rates, many lenders offer competitive options for borrowers with less-than-perfect credit. It’s essential to shop around and compare offers from different lenders to find a loan that suits your financial situation.

Low interest personal loans have hidden fees and charges

Another common misconception is that low interest personal loans come with hidden fees and charges that offset the savings from the low interest rate. In reality, reputable lenders are transparent about their fees and terms, allowing borrowers to understand the total cost of the loan before signing any agreements. Be sure to read the fine print and ask questions about any fees you don’t understand to avoid any surprises.

Low interest personal loans are difficult to qualify for

Some people believe that low interest personal loans are hard to qualify for due to stringent eligibility criteria. While lenders may have specific requirements, such as income verification and credit checks, many individuals can qualify for these loans with proper documentation and a stable financial background. It’s essential to review the eligibility criteria of different lenders to find one that matches your financial profile.

Best practices for comparing low interest personal loan offers

When looking to secure a low interest personal loan, it is crucial to compare offers from different lenders to ensure you are getting the best deal possible. This involves researching multiple lenders, reviewing loan terms, and analyzing total repayment costs.

Key factors to consider when evaluating loan terms

- Annual Percentage Rate (APR): This includes both the interest rate and any additional fees, providing a more accurate representation of the total cost of the loan.

- Loan amount: Make sure the lender offers the amount you need, as some may have minimum or maximum limits.

- Repayment period: Consider the length of the repayment term and how it aligns with your financial goals and ability to make payments.

- Prepayment penalties: Check if there are any penalties for paying off the loan early, as this can impact your overall cost.

Tips on negotiating with lenders

- Improve credit score: Work on improving your credit score before applying for a loan to qualify for lower interest rates.

- Leverage pre-approval offers: Use pre-approval offers to negotiate better terms with other lenders.

- Be open to different repayment options: Consider different repayment plans and terms to find the most suitable option for your financial situation.

How economic factors influence low interest personal loans

In today’s dynamic economic landscape, various factors play a crucial role in determining the availability and terms of low interest personal loans. Understanding how economic conditions impact these loans is essential for borrowers looking to secure favorable financing options.

Impact of inflation, interest rates, and market trends

- Inflation: High inflation rates can erode the purchasing power of money, leading lenders to increase interest rates on personal loans to maintain profitability.

- Interest Rates: Fluctuations in central bank rates can directly affect the cost of borrowing, influencing the interest rates offered on personal loans by financial institutions.

- Market Trends: Economic uncertainties or market volatilities can impact lenders’ risk assessment, leading to changes in interest rates and loan terms for borrowers.

Strategies for borrowers in changing economic conditions

- Monitor Interest Rates: Stay informed about prevailing interest rates and market trends to time loan applications for lower rates.

- Strengthen Credit Profile: Maintain a good credit score and stable employment status to enhance eligibility for low interest personal loans.

Global economic events and local interest rates

- Global Impact: Events like international trade agreements or economic crises can influence local interest rates, impacting the cost of personal loans.

- Exchange Rates: Currency fluctuations due to global economic events can indirectly affect interest rates on loans, especially in regions with strong trade ties.

Role of government policies and regulatory changes

- Stimulus Packages: Government interventions like stimulus packages can impact interest rates by injecting liquidity into the economy, potentially leading to lower borrowing costs.

- Regulatory Changes: Amendments in lending regulations can affect the availability of low interest personal loans by altering risk assessment criteria for lenders.

Fixed vs. Variable Interest Rates

- Fixed Rates: Offer stable monthly payments throughout the loan term, providing predictability but potentially missing out on lower rates during falling interest rate environments.

- Variable Rates: Offer flexibility with rates tied to market benchmarks, allowing borrowers to benefit from rate decreases but subjecting them to potential rate hikes.

Impact of economic downturns on loan terms

- Tightened Lending Criteria: During recessions, lenders may tighten eligibility criteria for low interest personal loans, making it harder for borrowers to secure favorable rates.

- Increased Default Risks: Economic downturns can increase default risks, prompting lenders to adjust interest rates or terms to mitigate potential losses.

Case studies or success stories of individuals benefiting from low interest personal loans

Low interest personal loans have been instrumental in helping individuals achieve their financial goals and improve their financial stability. Let’s explore some real-life examples of how strategic borrowing and responsible repayment have led to positive outcomes for borrowers.

Case Study 1: John’s Home Renovation Project

John, a homeowner, wanted to renovate his house but needed financial assistance. He opted for a low interest personal loan to cover the expenses. By carefully planning his budget and making timely repayments, John was able to complete the renovation within the set timeline and without straining his finances. The low interest rate on the loan helped him save money on interest payments, making it a cost-effective solution for his home improvement project.

Case Study 2: Sarah’s Debt Consolidation Journey

Sarah had accumulated multiple high-interest debts from credit cards and other sources, leading to financial stress. She decided to consolidate her debts by taking out a low interest personal loan. With the lower interest rate and manageable monthly payments, Sarah was able to pay off her debts faster and save money on interest charges. This financial strategy not only improved her credit score but also gave her a clear path towards financial freedom.

Ultimate Conclusion

In conclusion, low interest personal loans provide a valuable opportunity for individuals to access funds at affordable rates, ultimately leading to better financial outcomes. By carefully considering the pros and cons, exploring different lenders, and understanding the application process, borrowers can navigate the world of personal loans with confidence and ease. Embracing the possibilities offered by low interest personal loans can pave the way for a brighter financial future.