Loans Near Me: Convenient Options For Local Borrowers

Looking for loans near me? Whether you need quick cash or a long-term investment, finding the right local lender can make all the difference. From personal loans to mortgage options, explore the diverse world of borrowing right in your neighborhood.

Understanding Loans Near Me

When we talk about “loans near me,” we are referring to borrowing options that are available in close proximity to an individual’s location. These loans are typically offered by local banks, credit unions, or other financial institutions within the neighborhood or city where the borrower resides.

Examples of Situations

- Emergency expenses: Individuals may seek out loans near them when faced with unexpected medical bills, car repairs, or other urgent financial needs.

- Quick access to funds: Some borrowers prefer loans near their location for easy access to funds without the need to wait for lengthy approval processes.

- Personalized service: Borrowers who value face-to-face interactions and personalized assistance may opt for loans from local lenders.

Benefits of Loans Near Me

- Convenience: Borrowers can easily visit the lender’s office for inquiries, applications, and payments without the need for long-distance travel.

- Personalized assistance: Local lenders may offer more personalized service and tailored solutions based on the borrower’s specific needs and circumstances.

- Faster processing: Loans near me may have quicker approval and disbursement processes compared to online options, especially for urgent financial needs.

Types of Loans Offered Near Me

When looking for loans near you, it is important to understand the various types of loans that local lenders typically offer. Each type of loan has different features, eligibility requirements, and application processes. Below, we will explore and compare the most common types of loans available locally.

Personal Loans

Personal loans are unsecured loans that can be used for various purposes such as debt consolidation, home improvement, or unexpected expenses. These loans typically have fixed interest rates, repayment terms ranging from a few months to several years, and require a good credit score for approval.

Payday Loans

Payday loans are short-term loans designed to cover expenses until your next payday. These loans often come with high interest rates and fees, making them a costly borrowing option. Payday loans usually require proof of income and a checking account for approval.

Installment Loans

Installment loans are loans that are repaid over time with a set number of scheduled payments. These loans can be used for various purposes and typically have lower interest rates compared to payday loans. Eligibility requirements may include a minimum income level and a credit check.

Mortgage Loans

Mortgage loans are used to finance the purchase of a home. These loans have long repayment terms, typically 15 to 30 years, and can have fixed or adjustable interest rates. Mortgage loans require a good credit score, stable income, and a down payment for approval.

Auto Loans

Auto loans are used to finance the purchase of a vehicle. These loans can have fixed or variable interest rates and repayment terms ranging from a few years to several years. Eligibility criteria for auto loans may include a down payment, proof of income, and a credit check.

Finding Reliable Lenders Nearby

Finding a reliable lender nearby is crucial when seeking a loan to ensure a smooth and trustworthy borrowing experience. Here are some tips to help you identify reputable lenders in your vicinity:

Research and Verify

When looking for lenders nearby, it is essential to research and verify their credentials. Check if the lender is licensed and accredited by relevant authorities to offer financial services in your area. This accreditation ensures that the lender operates within legal boundaries and follows industry regulations, protecting you as a borrower.

Check Reviews and Ratings

Reading reviews and ratings from previous customers can give you valuable insights into the lender’s reputation and customer service. Look for feedback on online platforms, forums, or review websites to gauge the experiences of other borrowers. Positive reviews and high ratings are indicators of a trustworthy lender.

Avoid Predatory Practices

Be cautious of lenders who engage in predatory lending practices, such as charging exorbitant interest rates or hidden fees. Before signing any loan agreement, make sure to read the terms and conditions carefully and understand all the costs involved. Avoid lenders who pressure you into taking a loan or offer deals that seem too good to be true.

By following these tips and conducting thorough research, you can find a reliable lender nearby who meets your financial needs while prioritizing your best interests.

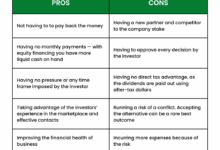

Pros and Cons of Getting Loans Near Me

When considering obtaining a loan from local lenders, there are several advantages and disadvantages to take into account. Local lenders offer convenience and personalized service, but there may be drawbacks such as higher interest rates or limited options compared to online lenders. It’s essential for individuals to carefully evaluate these factors before deciding to take out a loan from a nearby provider.

Advantages of Getting Loans Near Me

- Convenience: Easily accessible physical locations for inquiries and discussions.

- Personalized Service: Face-to-face interactions for tailored solutions and guidance.

- Quick Response: Immediate assistance and support during the loan application process.

Disadvantages of Getting Loans Near Me

- Potentially Higher Interest Rates: Local lenders may have higher interest rates compared to online options.

- Limited Options: Fewer loan products and variations available from local lenders.

- Less Flexibility: Strict terms and conditions may apply to loans from nearby providers.

Factors to Consider Before Choosing a Local Lender

- Interest Rates: Compare rates offered by local lenders with online options.

- Loan Terms: Understand the repayment terms and conditions before committing.

- Customer Reviews: Research feedback and reputation of local lenders for reliability.

Comparison between Local Lenders and Online Lenders

| Aspect | Local Lenders | Online Lenders |

|---|---|---|

| Application Process | Face-to-face or in-person application process. | Online application forms and submission. |

| Approval Time | Quick approval process with immediate feedback. | Varies but often faster due to automated systems. |

| Customer Support | Personalized support and assistance throughout the process. | Online and phone support available with limited personal interaction. |

Tips for Negotiating Terms with Local Lenders

- Research Rates: Understand the current market rates to negotiate better terms.

- Highlight Creditworthiness: Showcase your creditworthiness to secure favorable rates.

- Ask for Discounts: Inquire about any available discounts or promotions for loans.

Loan Approval Process for Nearby Lenders

When applying for a loan from nearby lenders, it is essential to understand the typical steps involved in the approval process, the documentation required, and how factors like credit scores and income levels can impact the approval decision.

Documentation Required for Loan Approval

- Proof of identity: This can be a driver’s license, passport, or any other government-issued ID.

- Proof of income: Pay stubs, tax returns, or bank statements to verify your financial stability.

- Credit history: Lenders may request your credit report to assess your creditworthiness.

- Collateral documents: If you are applying for a secured loan, documents related to the collateral may be required.

Timeline for Approval and Funding

- Approval process: Once you submit your application and required documents, lenders typically take a few days to review and approve your loan.

- Funding: After approval, the funds are usually disbursed within a week, depending on the lender’s policies and procedures.

Impact of Credit Scores and Income Levels

- Credit scores: A higher credit score increases your chances of loan approval and may also help you secure better interest rates.

- Income levels: Lenders consider your income level to ensure that you can repay the loan amount borrowed. Higher income levels may lead to better loan terms.

Interest Rates and Fees for Loans Near Me

When looking for loans near your location, understanding the interest rates and fees involved is crucial in determining the total cost of borrowing money. Local lenders may offer different rates and fees based on various factors, so it’s essential to compare and negotiate for the best deal.

Factors Influencing Interest Rates

- Interest rates offered by local lenders are typically influenced by the current economic conditions, the borrower’s credit score, the loan amount and term, and the lender’s policies.

- Factors such as the prime rate set by the Federal Reserve, inflation rates, and market competition can also impact interest rates.

Common Fees Associated with Loans

- Common fees associated with loans near your location may include origination fees, processing fees, late payment fees, and prepayment penalties.

- These fees can vary between lenders, so it’s important to carefully review the loan terms and conditions to understand the total cost.

Calculating Total Cost of a Loan

- To calculate the total cost of a loan, you can use the formula: Total Cost = Loan Amount + (Loan Amount * Interest Rate * Loan Term) + Fees

- By including the interest rate and fees in your calculations, you can have a clear understanding of how much you will need to repay.

Impact of Credit Score on Interest Rates

- Borrowers with higher credit scores are likely to qualify for lower interest rates from local lenders, as they are considered less risky.

- Improving your credit score before applying for a loan can help you secure better terms and lower interest rates.

Fixed vs. Variable Interest Rates

- Fixed interest rates remain constant throughout the loan term, providing predictability in monthly payments.

- Variable interest rates can fluctuate based on market conditions, potentially increasing or decreasing the total cost of the loan.

Comparison Table of Local Lenders

| Lender | Interest Rate | Fees |

|---|---|---|

| Lender A | 5.25% | $200 origination fee |

| Lender B | 4.75% | $100 processing fee |

Negotiating for Lower Rates

- When negotiating with local lenders, be prepared to provide documentation to support your creditworthiness and financial stability.

- Compare offers from different lenders to leverage better terms and negotiate for lower interest rates or reduced fees.

Repayment Options and Terms

When it comes to repaying loans from nearby lenders, it’s crucial to understand the repayment terms offered, as they can vary based on the type of loan and the lender. Here, we will dive into the details of repayment options and terms to help you navigate this aspect of borrowing responsibly.

Loan Durations and Payment Schedules

- Loan durations typically range from a few months to several years, depending on the type of loan and the lender’s policies.

- Payment schedules may be monthly, bi-weekly, or even weekly, so it’s essential to choose a repayment frequency that aligns with your budget and income.

Consequences of Late Payments or Defaulting

- Late payments can result in additional fees, a negative impact on your credit score, and potential legal action from the lender.

- Defaulting on a loan can lead to severe consequences, such as asset seizure, wage garnishment, and long-term damage to your credit history.

Managing Loan Repayments Effectively

- Create a budget to ensure you can meet your loan repayments on time each month.

- Consider setting up automatic payments to avoid missing due dates and incurring late fees.

- If you’re facing financial difficulties, contact your lender immediately to explore alternative repayment options.

Comparing Interest Rates and Fees

- Short-term loans often have higher interest rates but lower overall costs compared to long-term loans.

- Long-term loans may have lower monthly payments but result in higher total interest paid over the loan term.

Renegotiating Repayment Terms

- If you encounter financial challenges, communicate with your lender to discuss the possibility of restructuring your repayment plan.

- Lenders may offer options such as loan modification, forbearance, or deferment to help you manage your payments effectively.

Impact of Early Repayment

- Early repayment can lead to significant interest savings and reduce the overall cost of the loan.

- Before making early repayments, check with your lender to ensure there are no prepayment penalties or fees associated with paying off the loan ahead of schedule.

Impact of Loans Near Me on Credit Score

When considering loans near me, it’s essential to understand how they can affect your credit score. The proximity of the lender can play a significant role in determining the terms and conditions of the loan, which, in turn, can impact your credit score positively or negatively.

Factors Considered by Local Lenders

Local lenders often take into account factors such as your income, employment status, credit history, and debt-to-income ratio when approving loans for individuals in the nearby area. Being close to the lender may also allow for a more personalized evaluation of your financial situation.

Impact of Proximity on Loan Terms

The proximity of the lender can affect the terms and conditions of the loan in various ways. For example, local lenders may offer more flexible repayment options or lower interest rates to borrowers in their community. On the other hand, they may have stricter requirements or less competitive rates compared to national or online lenders.

Benefits and Drawbacks of Choosing a Local Lender

Choosing a local lender for a loan can have its advantages, such as better customer service, personalized attention, and potential community support. However, it may also limit your options and could lead to higher interest rates or fees compared to larger financial institutions.

Community-Based Loans and Credit Score

Community-based loans from nearby institutions can impact your credit score differently compared to traditional financial institutions. These loans may strengthen your credit profile by diversifying your credit sources and demonstrating responsible borrowing behavior to credit agencies.

Maintaining a Healthy Credit Score

Credit utilization and diversification of credit sources play a crucial role in maintaining a healthy credit score after taking out a loan from a local lender. Monitoring your credit report regularly and identifying any discrepancies can help you address issues promptly and prevent negative impacts on your credit score.

Monitoring Credit Report Changes

After obtaining a loan from a lender in close proximity, it’s important to monitor your credit report for any changes. Keep an eye out for new accounts, inquiries, or discrepancies that could affect your credit score. By staying vigilant and addressing any issues promptly, you can protect your credit score and financial well-being.

Customer Support and Assistance

Customer support services provided by local lenders play a crucial role in assisting borrowers throughout their loan journey. Good customer service can make a significant difference in the overall borrowing experience and satisfaction.

Reaching Out for Help

- Borrowers can contact customer support through various channels such as phone, email, live chat, or in-person visits.

- Examples of financial concerns that borrowers may seek assistance for include payment schedule adjustments, understanding terms and conditions, or resolving billing discrepancies.

Importance of Good Customer Service

- Choosing a lender nearby with excellent customer service ensures that borrowers receive timely and accurate assistance whenever needed.

- Responsive and helpful customer support can enhance trust and satisfaction in the lending process.

Contacting Customer Support

- Step 1: Gather relevant loan information such as account number, loan amount, and specific concerns.

- Step 2: Choose a preferred communication channel based on urgency and convenience.

- Step 3: Clearly explain the issue or inquiry to the customer support representative.

Response Times and Availability

| Customer Support Channel | Response Time | Availability |

|---|---|---|

| Phone | Immediate to 24 hours | Business hours |

| Within 24-48 hours | 24/7 | |

| Live Chat | Immediate to 1 hour | Business hours |

| In-person Visits | Immediate | By appointment |

Escalating Issues

- If a borrower is not satisfied with the initial customer support interaction, they can request to speak with a supervisor or escalate the matter to a higher authority within the lending institution.

- Providing detailed information about the concern and previous interactions can expedite the resolution process.

Proactive Engagement

- Local lenders can proactively engage with borrowers through educational resources, timely notifications, and personalized assistance to prevent potential issues and guide borrowers towards successful loan management.

- Offering proactive support can build strong relationships with borrowers and enhance overall customer satisfaction.

Loan Refinancing and Consolidation Options

When individuals have multiple loans from local lenders, they may consider options like loan refinancing and consolidation to manage their debt more effectively. Refinancing involves taking out a new loan to pay off existing loans, usually with better terms, while consolidation combines multiple loans into a single loan with a new repayment plan.

Benefits of Loan Refinancing and Consolidation

- Lower Interest Rates: Refinancing or consolidating loans can potentially result in lower interest rates, saving money in the long run.

- Simplified Repayment: Combining multiple loans into one can simplify the repayment process, making it easier to manage finances.

- Improved Credit Score: Timely payments on a refinanced or consolidated loan can positively impact credit scores.

Drawbacks of Loan Refinancing and Consolidation

- Extended Repayment Period: While monthly payments may decrease, extending the repayment period can result in paying more interest over time.

- Additional Fees: Refinancing or consolidating loans may come with fees, which could offset the potential savings.

- Impact on Credit Score: Opening a new loan or closing old accounts can temporarily impact credit scores.

Legal Regulations and Consumer Rights

In the realm of loans near me, it is crucial for borrowers to understand the legal regulations and consumer rights that govern their interactions with lenders. By being well-informed about the process of obtaining a loan and the key requirements they need to fulfill, borrowers can protect themselves from potential pitfalls and ensure a smooth borrowing experience.

Consequences of Defaulting on a Loan and Consumer Rights

Defaulting on a loan can have serious consequences for borrowers, including damage to their credit score, accumulation of additional fees and penalties, and potential legal action by the lender. However, consumers have rights in such situations, including the right to receive a notice of default, the right to dispute any inaccuracies in the loan account, and the right to seek assistance from a credit counselor or financial advisor.

Predatory Lending Practices and Reporting Procedures

Predatory lending practices, such as exorbitant interest rates, hidden fees, and deceptive marketing tactics, can trap unsuspecting borrowers in a cycle of debt. Consumers can protect themselves by being aware of these practices and reporting any suspicious behavior to the relevant authorities, such as the Consumer Financial Protection Bureau or the state attorney general’s office.

Comparison of Different Types of Loans

To help borrowers make informed decisions, it is essential to compare the interest rates, repayment terms, and fees of different types of loans available. Below is a comparison table detailing the key differences between personal loans, payday loans, and title loans:

| Loan Type | Interest Rate | Repayment Terms | Fees |

|---|---|---|---|

| Personal Loan | 8-25% | 1-7 years | Origination fee, late payment fee |

| Payday Loan | 200-400% | 2 weeks | Finance charge, rollover fee |

| Title Loan | 300-700% | 30 days | Title fee, repossession fee |

Filing Complaints and Seeking Redress

If consumers feel that their rights have been violated by a lender, they can take action by filing a complaint with the appropriate regulatory agency or seeking redress through legal channels. Here is a step-by-step guide on how consumers can voice their concerns and seek justice:

- Gather all relevant documents and evidence to support your claim.

- Contact the lender directly to try to resolve the issue amicably.

- File a complaint with the Consumer Financial Protection Bureau or your state attorney general’s office.

- Seek legal advice from a qualified attorney if necessary.

Loan Comparison Tools and Resources

When looking for a loan near you, it’s essential to compare different options to find the best fit for your financial needs. Fortunately, there are various tools and resources available to help individuals make informed decisions when choosing a loan from nearby lenders.

Websites for Loan Comparison

- Bankrate: Bankrate is a popular platform that allows users to compare interest rates, fees, and terms from different lenders in their area.

- LendingTree: LendingTree offers a comparison tool that enables borrowers to compare multiple loan offers side by side, making it easier to choose the most suitable option.

- Credible: Credible is another website that provides a convenient way to compare loan offers from various lenders, helping borrowers find the best rates available.

Benefits of Using Comparison Tools

- Empowers Borrowers: By using loan comparison tools, borrowers can easily compare key aspects of different loan offers, such as interest rates, fees, and repayment terms, empowering them to make well-informed decisions.

- Saves Time: Instead of individually researching and contacting multiple lenders, comparison tools streamline the process, saving borrowers time and effort.

- Ensures Best Deal: Comparing loans allows borrowers to find the best deal that fits their financial situation, potentially saving them money in the long run.

Tips for Responsible Borrowing

Responsible borrowing is essential for maintaining financial stability and well-being. By following certain tips and strategies, individuals can ensure they borrow wisely and manage their loans effectively.

Create a Budget and Plan Ahead

- Start by analyzing your income and expenses to determine how much you can afford to borrow.

- Set a budget that includes loan repayments to ensure you can meet your financial obligations.

- Plan for unexpected expenses and emergencies to avoid relying solely on loans for financial support.

Understand Loan Terms and Conditions

- Read and fully understand the terms and conditions of the loan before signing any agreement.

- Pay attention to interest rates, fees, repayment schedules, and any penalties for late payments.

- Clarify any doubts with the lender to avoid surprises or misunderstandings later on.

Avoid Falling into Debt Traps

- Avoid borrowing more than you can afford to repay, as it can lead to a cycle of debt and financial stress.

- Avoid taking out multiple loans simultaneously, as it can strain your finances and lead to difficulty in repayment.

- Seek financial advice or counseling if you are struggling with debt or loan repayments to find a sustainable solution.

Conclusive Thoughts

In conclusion, loans near me offer a blend of convenience and personalized service that online options may lack. By understanding the types of loans available locally and the factors to consider, borrowers can make informed decisions that suit their financial needs.