Loans For Bad Credit: Accessing Financial Opportunities Despite Poor Credit History

Loans for bad credit sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with formal and friendly language style and brimming with originality from the outset.

As individuals navigate the complex landscape of financial opportunities, the concept of bad credit loans emerges as a beacon of hope, providing a pathway to access much-needed funds despite a checkered credit history.

Introduction to Loans for Bad Credit

Loans for bad credit are financial products designed specifically for individuals with poor credit scores. These loans provide a lifeline for those who may struggle to qualify for traditional loans due to their credit history.

Challenges Faced by Individuals with Bad Credit

Individuals with bad credit face numerous challenges when seeking loans, such as higher interest rates, limited loan options, and stricter eligibility criteria.

Importance of Bad Credit Loans in Financial Inclusion

Bad credit loans play a crucial role in financial inclusion by providing access to credit for individuals who would otherwise be excluded from the traditional banking system.

Benefits of Bad Credit Loans

- Emergency expenses: Bad credit loans can help individuals cover unexpected costs, such as medical bills or car repairs.

- Debt consolidation: These loans can be used to consolidate high-interest debt into a single, more manageable payment.

- Opportunity for credit repair: Timely repayment of bad credit loans can help improve credit scores over time.

Interest Rates for Bad Credit Loans

Interest rates for bad credit loans are typically higher than those for traditional loans, reflecting the increased risk to lenders. Borrowers with bad credit can expect to pay more in interest charges.

Secured vs. Unsecured Bad Credit Loans

Secured bad credit loans require collateral, such as a car or home, to secure the loan. Unsecured bad credit loans do not require collateral but often come with higher interest rates.

Impact on Credit Scores

Timely repayment of bad credit loans can have a positive impact on credit scores, demonstrating responsible financial behavior to credit bureaus.

Tips for Improving Credit Scores

- Pay bills on time: Timely payments are crucial for improving credit scores.

- Reduce credit card balances: Lowering credit card balances can positively impact credit utilization ratios.

- Check credit reports: Regularly monitoring credit reports can help identify errors and address issues promptly.

Types of Loans Available for Bad Credit

When it comes to obtaining a loan with bad credit, there are several options available to individuals in need of financial assistance. Here, we will explore the different types of loans suitable for those with poor credit scores and discuss the eligibility criteria for each.

Secured Loans

Secured loans are backed by collateral, such as a home or a car, which reduces the risk for the lender. Due to the presence of collateral, individuals with bad credit may have an easier time qualifying for a secured loan. However, failure to repay the loan could result in the loss of the collateral.

Unsecured Loans

Unsecured loans do not require collateral and are based solely on the borrower’s creditworthiness. While these loans may be more challenging to qualify for with bad credit, they typically come with higher interest rates. Examples of unsecured loans include personal loans and credit cards.

Payday Loans

Payday loans are short-term, high-interest loans that are typically used to cover unexpected expenses until the borrower’s next payday. These loans are easy to qualify for, even with bad credit, but come with extremely high fees and interest rates, making them a costly borrowing option.

Peer-to-Peer Loans

Peer-to-peer loans involve borrowing money from individuals rather than traditional financial institutions. These loans may be more flexible in terms of credit requirements, making them an option for individuals with bad credit. However, interest rates can vary widely depending on the lender and the borrower’s credit profile.

Installment Loans

Installment loans involve borrowing a specific amount of money and repaying it in fixed monthly installments over a set period. While these loans may be available to individuals with bad credit, they often come with higher interest rates to offset the increased risk to the lender.

Benefits of Loans for Bad Credit

Taking out a loan despite having bad credit can offer several advantages for individuals looking to improve their financial situation. These loans are specifically designed to help those with less-than-perfect credit scores access much-needed funds in times of need.

Improving Credit Scores

Securing a bad credit loan and making timely repayments can actually help improve credit scores over time. By demonstrating responsible borrowing behavior, individuals can show lenders that they are capable of managing their finances effectively.

Financial Flexibility

Bad credit loans can be a good financial decision in situations where individuals need quick access to cash for emergencies, unexpected expenses, or debt consolidation. These loans provide the flexibility to address various financial needs without having to rely on high-interest credit cards or payday loans.

Secured vs. Unsecured Loans

Secured bad credit loans require collateral, such as a car or property, which can lower the risk for lenders and potentially result in lower interest rates. On the other hand, unsecured bad credit loans do not require collateral but may come with higher interest rates due to the increased risk for lenders.

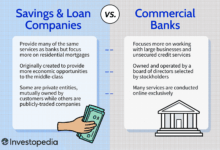

Potential Lenders

There are various lenders who specialize in offering bad credit loans, including online lenders, credit unions, and some traditional banks. It’s important to research and compare different lenders to find the best terms and rates that suit individual financial needs.

Application Process

When applying for a bad credit loan, individuals may need to provide proof of income, identification, and other relevant documents to demonstrate their ability to repay the loan. The approval process may vary depending on the lender, but having all necessary documents ready can expedite the process.

Managing Responsibly

It’s crucial to responsibly manage a bad credit loan by making timely payments and avoiding taking on more debt than necessary. By staying on top of repayments, individuals can avoid further financial difficulties and work towards improving their credit score over time.

Alternative Options

In addition to bad credit loans, individuals can explore alternative options such as credit counseling, debt consolidation, or working with a financial advisor to improve their financial situation. These alternatives can provide additional support and guidance in managing debt and rebuilding credit.

Risks Associated with Bad Credit Loans

When considering taking out a loan with bad credit, it’s crucial to understand the potential risks involved. These risks can have long-lasting consequences on your financial health if not managed properly.

Impact of High-Interest Rates on Bad Credit Loans

Bad credit loans often come with significantly higher interest rates compared to traditional loans. This means you’ll end up paying much more in interest over the life of the loan, increasing the total cost of borrowing.

Consequences of Defaulting on Bad Credit Loans

If you default on a bad credit loan, it can severely damage your credit score and make it even harder to qualify for loans in the future. Moreover, lenders may take legal action against you to recover the outstanding amount, leading to additional financial stress.

Using Collateral for Bad Credit Loans

Some bad credit loans require collateral, such as your car or home, to secure the loan. If you fail to repay the loan, you risk losing the collateral, putting your assets at stake.

Options for Restructuring Bad Credit Loans

If you’re struggling to make payments on your bad credit loan, you may have the option to restructure the loan by negotiating with the lender. However, this may involve additional fees or higher interest rates, so it’s essential to weigh the pros and cons carefully.

Long-Term Effects of Bad Credit Loans on Credit Scores

Continuously carrying bad credit loans and missing payments can have a lasting impact on your credit score. A poor credit score can make it challenging to secure favorable loan terms in the future, affecting your ability to borrow money at reasonable rates.

How to Find Lenders Offering Bad Credit Loans

Finding reputable lenders that offer loans for bad credit can be a daunting task, but with the right approach, it is possible to secure the financial assistance you need. Here are some tips to help you navigate the process effectively:

Research and Identify Reputable Lenders

- Start by researching online and looking for lenders who specialize in bad credit loans.

- Check reviews and ratings from previous customers to gauge the reliability and credibility of the lender.

- Verify that the lender is licensed and registered to operate in your state to avoid falling victim to scams.

Read Terms and Conditions Carefully

- Before applying for a bad credit loan, carefully read and understand all the terms and conditions associated with the loan.

- Pay attention to the interest rates, fees, repayment terms, and any other relevant information that may impact your financial situation.

- Seek clarification from the lender if you have any doubts or questions about the loan agreement.

Compare Different Bad Credit Loan Offers

- Collect loan offers from multiple lenders and compare the interest rates, fees, and repayment terms to find the most favorable option.

- Consider the total cost of the loan over its term to ensure that you can afford the repayments.

- Use online comparison tools and calculators to simplify the process and make an informed decision.

Strategies to Improve Credit Score Before Applying for a Loan

Improving your credit score before applying for a loan is crucial to secure better terms and rates. Here are some actionable strategies to boost your credit score:

Review and Dispute Credit Report Errors

- Regularly check your credit report for inaccuracies and dispute any errors promptly.

- Errors in your credit report can negatively impact your score, so it’s essential to address them.

Make Timely Payments and Reduce Debt

- Consistently making on-time payments on your existing debts can improve your credit score significantly.

- Paying down your debt balances will lower your credit utilization ratio, positively affecting your score.

Understand Credit Score Calculation Factors

- Factors like payment history, credit utilization, length of credit history, new credit, and credit mix contribute to your credit score.

- Knowing how these factors impact your score can help you prioritize areas for improvement.

Engage in Credit-Building Activities

- Using credit cards responsibly by keeping balances low and paying in full each month can establish a positive credit history.

- Diversifying your credit mix by having different types of credit accounts can also boost your score.

Utilize Credit Monitoring Services

- Signing up for credit monitoring services can help you track changes to your credit report and detect any suspicious activity.

- Being proactive in monitoring your credit can prevent identity theft and other fraudulent activities.

Negotiate with Creditors to Settle Debts

- If you have outstanding debts, consider negotiating with creditors to settle for a lower amount or establish a payment plan.

- Settling debts can help improve your credit score over time by showing a commitment to resolving financial obligations.

Avoid Common Pitfalls

- Avoid missing payments, as late payments can significantly impact your credit score.

- Avoid applying for multiple credit accounts within a short period, as it can signal financial distress to lenders.

Alternatives to Traditional Bad Credit Loans

When facing a situation of bad credit, there are alternative options available that can help individuals secure the financial assistance they need without resorting to traditional bad credit loans.

Credit Unions or Peer-to-Peer Lending

Credit unions and peer-to-peer lending platforms can be viable alternatives for individuals with bad credit. These institutions may have more flexible lending criteria and lower interest rates compared to traditional banks.

Co-Signing a Loan

Co-signing a loan for someone with bad credit can be a way to access better loan terms. However, it’s crucial to understand the responsibilities and risks associated with being a co-signer, as any default can impact both parties’ credit scores.

Building a Savings Account

Instead of relying on bad credit loans, building a savings account can serve as a financial safety net for unforeseen expenses. By consistently saving and growing your emergency fund, you can reduce the need for high-interest loans in the future.

Loan Repayment Strategies for Bad Credit Borrowers

Managing loan repayments effectively is crucial for borrowers with bad credit. Timely payments can help improve credit scores and avoid further financial difficulties.

Creating a Budget

One effective strategy for bad credit borrowers is to create a detailed budget to track income and expenses. By knowing exactly how much money is coming in and going out each month, borrowers can allocate funds for loan repayments.

Timely Payments

It is essential for borrowers to make timely payments on their bad credit loans. Late payments can result in additional fees and negatively impact credit scores. Setting up automatic payments or reminders can help ensure payments are made on time.

Consequences of Defaulting

Defaulting on bad credit loan repayments can have serious consequences, including legal action, collection calls, and further damage to credit scores. Borrowers should communicate with lenders if they are facing financial difficulties to explore alternative repayment options.

Impact of Bad Credit Loans on Financial Health

Taking out a bad credit loan can have a significant impact on an individual’s overall financial well-being. While these loans may provide immediate financial relief, they can also lead to long-term financial challenges if not managed responsibly.

Increased Debt Burden

One of the primary consequences of relying on bad credit loans is the potential for increased debt burden. High-interest rates and fees associated with these loans can make it difficult for borrowers to repay the borrowed amount in full.

Negative Credit Score Effects

Defaulting on bad credit loans can further damage an individual’s credit score, making it even harder to access affordable credit in the future. This can limit financial opportunities and increase the cost of borrowing.

Limited Financial Flexibility

Relying on bad credit loans as a regular source of funding can limit financial flexibility and increase dependency on high-cost borrowing options. This can lead to a cycle of debt that is challenging to break free from.

Regulations and Consumer Protections for Bad Credit Borrowers

When it comes to borrowing with bad credit, there are laws and regulations in place to protect individuals from unfair practices. These regulations aim to ensure that borrowers are not taken advantage of and are provided with transparent and reasonable loan terms.

Role of Regulatory Bodies in Monitoring Lenders

Regulatory bodies play a crucial role in monitoring lenders who offer loans to individuals with bad credit. These bodies set guidelines and rules that lenders must follow to protect consumers from predatory lending practices.

- Regulatory bodies conduct regular inspections and audits to ensure that lenders comply with the set regulations.

- They also investigate complaints from borrowers regarding unfair practices and take appropriate action against lenders found to be violating the rules.

Consumer Rights and Resources for Bad Credit Borrowers

Bad credit borrowers have rights and resources available to them to help navigate the borrowing process and protect themselves from exploitation.

- Consumers have the right to receive clear and accurate information about the terms and conditions of the loan.

- They can seek assistance from consumer protection agencies or legal aid organizations if they believe they have been treated unfairly by a lender.

Comparative Analysis of Regulations Across Countries

The regulations surrounding bad credit loans can vary from one country to another, with some nations implementing stricter rules than others.

| Country | Regulatory Framework |

|---|---|

| United States | The US has the Consumer Financial Protection Bureau (CFPB) overseeing lending practices and ensuring consumer protection. |

| United Kingdom | The Financial Conduct Authority (FCA) regulates the financial services sector, including bad credit loans, to protect consumers. |

Consequences for Lenders Violating Regulations

Lenders who violate the regulations for bad credit loans can face severe consequences, including fines, revocation of licenses, and legal action.

- Financial penalties may be imposed on lenders found to be engaging in unfair or deceptive practices.

- In extreme cases, lenders may be forced to shut down their operations if they repeatedly violate regulations.

Tips to Avoid Predatory Lending Practices

Bad credit borrowers can protect themselves from predatory lending practices by following some practical tips:

- Always read and understand the terms of the loan before signing any agreement.

- Avoid lenders who pressure you into taking out a loan or offer deals that seem too good to be true.

Filing Complaints Against Unfair Lending Practices

If a bad credit borrower believes they have been a victim of unfair lending practices, they can take action by filing a complaint with the relevant regulatory authority or consumer protection agency.

- Provide detailed information about the issue, including any evidence or documentation to support your claim.

- Cooperate with authorities during the investigation process to ensure that justice is served.

Case Studies

Exploring real-life experiences with bad credit loans can provide valuable insights into the challenges and successes that borrowers face. By sharing these case studies, we can learn from the lessons and outcomes of individuals who have utilized bad credit loans to improve their financial situations.

Success Stories

- Alex struggled with a low credit score but was able to secure a bad credit loan to consolidate his debts. Through disciplined repayment and budgeting, he successfully paid off the loan and saw a significant improvement in his credit score.

- Emily faced unexpected medical expenses and turned to a bad credit loan for assistance. Despite the high interest rates, she managed to repay the loan on time and avoid further financial hardship.

Challenges Faced by Borrowers

- Navigating the loan process with bad credit can be daunting, as many traditional lenders may reject applications based on credit scores alone.

- Borrowers often encounter higher interest rates and fees with bad credit loans, making it crucial to carefully assess the terms and conditions before committing to a loan.

Lessons Learned

- From these experiences, we can glean the importance of responsible borrowing and budgeting to successfully manage bad credit loans.

- Building a positive credit history through timely repayments and financial planning is essential for improving credit scores and accessing better loan options in the future.

Tips for Responsible Borrowing with Bad Credit Loans

When considering bad credit loans, it’s crucial to borrow responsibly to avoid further financial challenges. Understanding loan terms, managing debt effectively, and improving credit score are essential steps in this process.

Importance of Understanding Loan Terms

- Before signing any agreements, carefully review the terms and conditions of the loan to avoid any surprises later on.

- Clarify the interest rates, repayment schedule, and any fees associated with the loan to make informed borrowing decisions.

Difference Between Secured and Unsecured Loans

- Secured bad credit loans require collateral, while unsecured loans do not. Understanding this difference can impact the risk involved in borrowing.

- Secured loans may offer lower interest rates but pose a higher risk of losing the collateral if payments are not made on time.

Calculating the Total Cost of Borrowing

- Use a step-by-step guide to calculate the total cost of borrowing, including interest rates and any additional fees involved.

- Knowing the total cost upfront can help you budget effectively and avoid taking on more debt than you can afford.

Improving Credit Score for Better Loan Terms

- Focus on improving your credit score over time by making timely payments, reducing debt, and monitoring your credit report for any errors.

- A higher credit score can potentially qualify you for better loan terms and lower interest rates in the future.

Consequences of Defaulting on a Loan

- Defaulting on a bad credit loan can have serious repercussions, including damage to your credit score and legal action by the lender.

- If you’re struggling to make payments, communicate with your lender to explore alternative repayment options before defaulting.

Tools for Tracking Loan Payments

- Utilize resources or tools to track your loan payments and stay organized with your personal finances.

- Setting reminders, creating a budget, and monitoring your spending can help you manage debt and payments effectively.

Future Trends in the Bad Credit Loan Industry

The bad credit loan industry is constantly evolving, driven by various factors such as technological advancements, changing consumer behaviors, and regulatory developments. Understanding the future trends in this sector is crucial for both borrowers and lenders to adapt and thrive in this dynamic environment.

Emerging Technologies in Bad Credit Lending

Technology and data analytics are revolutionizing the way bad credit loans are offered and processed. With the use of artificial intelligence and machine learning algorithms, lenders can now assess creditworthiness more accurately and efficiently, leading to faster approval processes and improved borrower experiences.

Alternative Credit Scoring Models

Traditional credit scoring models have limitations, especially for individuals with limited credit history or poor credit scores. Alternative credit scoring models, based on factors such as transaction data, social media behavior, and even educational background, are gaining traction in the industry. These models provide a more holistic view of a borrower’s financial profile, enabling more inclusive lending practices.

Inclusive Approaches to Bad Credit Lending

In the past decade, there has been a shift towards more inclusive approaches in bad credit lending. Lenders are exploring new ways to assess creditworthiness beyond traditional metrics, considering factors like employment history, income stability, and even personal references. This trend aims to provide opportunities for borrowers who may have been overlooked by conventional lending criteria.

Timeline of Bad Credit Loan Evolution

Over the years, bad credit loan products and services have undergone significant changes. From the introduction of online lending platforms to the adoption of mobile banking solutions, the industry has witnessed a transformation in how loans are offered and managed. This timeline illustrates the evolution of bad credit lending practices and the impact of technological advancements on borrower experiences.

Closing Summary

In conclusion, loans for bad credit not only offer a lifeline for those in challenging financial situations but also pave the way for improved credit scores and long-term financial stability. By understanding the nuances of bad credit loans and embracing responsible borrowing practices, individuals can embark on a journey towards financial empowerment and security.